Introduction

Gold has retained its value as a currency, jewelry, art, and manufacturing material for centuries. Furthermore, gold is frequently considered to be a secure haven for your assets during times of economic uncertainty and inflation. According to The Washington Post, during the COVID-19 pandemic, the gold price peaked at more than $2,000 per ounce in August 2020.

What Are Gold Mining Stocks?

Humans have valued gold for thousands of years. It was the currency of some of the world’s most famous civilizations, including Ancient Egypt and Rome. From the late nineteenth century until the onset of World War One, the value of currencies was anchored to a specific amount of gold. While gold is no longer used as an official currency, its price remains an influential factor in financial markets and global economies.

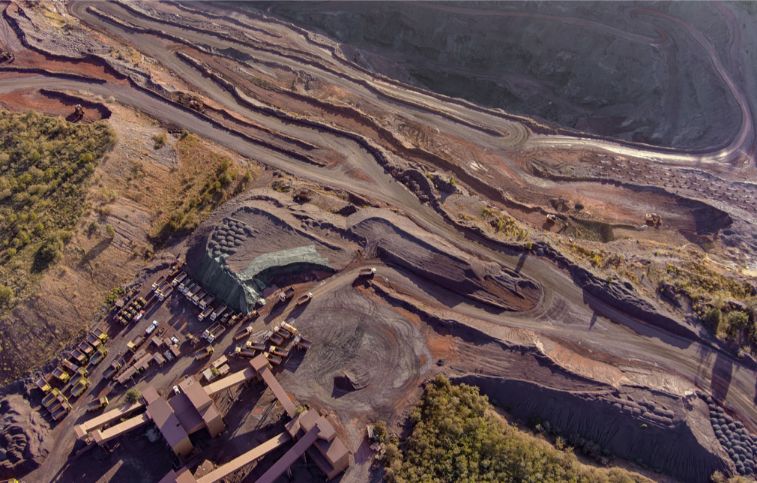

Gold mining stocks are shares in gold mining and exploration companies. They are available on stock markets, enabling you to receive a portion of the profits when a company grows and profits significantly. Instead of purchasing physical gold, you can accelerate asset growth by investing in gold companies.

Investing in gold stocks means your investment potential fluctuates in conjunction with the worth of gold mining companies. For example, the value of your gold stock is likely to rise whenever an exploration company discovers a new site. However, the value will almost certainly fall if that same company reduces its production.

Factors That Affect Gold Prices

The global gold industry is truly unique, and comprehending the sector’s uniqueness begins with understanding that physical gold is practically indestructible. Unlike other metals, it does not corrode, rust, or degrade.

The direct implication of this quality is that every ounce of gold ever mined in the approximately seven thousand years that humans have sought gold is still around. Below are some of the vital factors that affect the global market price of gold.

1. Stability

Gold is regarded as a relatively safe asset because it is the foundational financial instrument underlying global currencies. Its value rises during times of turmoil as governments and investors seek a hedge against uncertainty. In contrast, gold prices typically fall during stable times as riskier but potentially more profitable investment avenues become more viable.

2. Demand and Supply

As with most other assets traded on the market, an excess demand for gold increases the price of gold (assuming supply is constant). On the other hand, a decrease in demand often has the opposite effect on its value, causing the price to fall (assuming supply is constant).

3. Central Banks

Many of the world’s gold reserves are held by central banks. As a result, these financial institutions have massive control over global gold prices. If banks suddenly decreased or increased their gold access, even slightly, the effect on the gold price would be magnified.

4. Exchange Traded funds (ETFs)

While exchange-traded funds are generally designed to mirror rather than influence the gold price, many large ETFs hold significant amounts of physical gold. As a result, the inflows and outflows from such ETFs can affect the metal’s price by changing the market’s physical supply and demand.

5. The U.S. Dollar

Gold’s correlation with the U.S. Dollar is a central talking point, as the U.S. Dollar remains the gold’s benchmark pricing mechanism. When the value of the U.S. dollar rises, gold becomes more costly for other countries to purchase.

As a result, demand falls, which is why there is generally an inverse relationship between the U.S. Dollar and the gold price. Furthermore, investors turn to gold as a safer alternative when the U.S. dollar begins to lose value, which increases its price.

Uses Of Gold

l Jewelry

The most popular way for gold to reach consumers is through jewelry, which has historically been the main application for the metal across different cultures. Gold jewelry is a treasured accessory because of its elegant appearance and robust qualities.

- A Form of Currency and Investment Option

Gold has served as a natural currency for at least 6,000 years because it is a precious metal that is both scarce and highly valued. The United States used to hold all of its monetary currency to a gold standard, and nowadays, many investors still consider it a viable investment option.

l Dentistry

Since 700 B.C., gold has been used in dentistry, and it will likely always be the best choice for restoring damaged or missing teeth. It is the best metal for fillings, crowns, and orthodontic applications because it is non-allergenic, chemically inert, and easy to insert. Small quantities of gold isotopes are also used in the medical field for some radiation treatments and diagnostic procedures.

l Awards and Medals

Gold is among the most prestigious status symbols because of its unmatched beauty and rarity. It is acknowledged for its admirable characteristics and holds a permanent place of value in the eyes of humanity in almost all competitions globally, from the Oscars and the World Cup to Olympic medals.

l Electronics

A small amount of gold is present in almost all electronic devices, such as cell phones, GPS units, televisions, etc., because of its excellent electrical conductivity and capability to transmit electrical charges.

How to Invest in Gold

Contrary to popular belief, purchasing physical gold is neither better nor worse than buying gold mining stock, as it mainly depends on your financial objectives. While shares of gold companies are typically more profitable in the short term, gold bullion may offer greater financial security over the long term.

Physical Gold

Purchasing physical gold in the form of gold bullion, jewelry, or coins, is one of the most common ways to invest in the metal. Having a tangible object in your possession ensures that you will always have access to it should the need arise.

l Gold Bullion

Gold bullion is available in bars with weights ranging from a few grams to 400 ounces, but one- and 10-ounce bars are the most popular sizes. Due to the high cost of gold bullion, working with a reputable dealer is particularly crucial. It’s also a good idea to monitor gold prices so you can decide when to buy because most dealers base their prices on the most recent market prices.

l Gold Coins

Investors typically purchase gold coins from private merchants at a premium of between 1% and 5% over their integral gold value, but in some cases, the premium can increase to around 10%. However, the prices of gold coins may not always reflect the amount of gold they contain.

The most popular gold coins are collectibles, such as American Gold Eagles, South African Krugerrands, and Canadian Maple Leafs. For instance, the retail price of an ounce American Gold Eagle coin is currently just over $2,000 as of mid-September 2020. Over an equivalent amount of gold bullion, that represents a markup of almost 5%.

l Gold Jewelry

You can also purchase gold in the form of gold jewelry, which you can wear or keep as a collectible. Jewelry is typically not the best choice if it’s just for investment purposes because the retail price will typically be significantly higher than the meltdown value. This is a result of the craftsmanship and retail markup.

The karat scale is used to determine the purity of gold, with 24 karats representing 100% gold. Lower purity would lower the melt value of your jewelry’s parts if melted down to pure gold.

Gold Mining Stocks

It is much simpler to invest in the stock of companies that mine, refine, and trade gold than it is to purchase physical gold. Below are some of the advantages of investing in gold mining stocks.

High liquidity: It might be difficult to sell certain assets quickly for cash. However, the liquidity of a gold stock is relatively high. So, you can sell your stocks if you want to reallocate funds or make a sizable purchase.

Market accessibility: You don’t have to be a highly qualified trader or a well-known businessperson to invest in shares of mining companies. Getting started is simple if you have some prior knowledge and market experience.

Diversification of portfolios: One of the main reasons investors prefer the gold market is to diversify their holdings. You won’t have to be concerned about market volatility or economic crises if you spread your wealth.

Protection from inflation: As a result of inflation, a dollar no longer has the same purchasing power as it once did; therefore, people with large amounts of paper money aren’t as wealthy as they once were. You can hedge your money and safeguard your finances against inflation by purchasing gold mining stocks.

Mutual Funds and Gold-related ETFs

Investing in one of the gold-based exchange-traded funds can serve as a substitute for buying gold bullion directly. These specialized instruments are divided into shares, with each share representing a specific quantity of gold, such as one-tenth of an ounce.

Similar to buying and selling stocks, these funds can be bought and sold in any stock broker or IRA. For small investors, this method is simpler and more cost-effective than directly owning bars or coins because the minimum investment is only the cost of one share of the ETF.

These funds’ annual average expense ratios are typically around 0.57%, which is a significant decrease from the costs and fees associated with many other investments, including the majority of mutual funds.

ETFs follow a passive index-tracking strategy and, as a result, have lower expense ratios than traditional mutual funds, which are actively managed. Mutual funds and ETFs are typically the simplest and safest ways to invest in gold for the average gold investor.

Gold Futures and Options

Futures are agreements to buy or sell a specific quantity of an asset—in this case, gold—on a specific future date. Standardized futures contracts represent a predetermined quantity of gold. Therefore, futures are better suited for experienced investors due to the associated amount of their potential size (for instance, 100 troy ounces multiplied by $1,000/ounce equals $100,000).

Due to their low commissions and low margin requirements compared to traditional equity investments, most people frequently prefer investing in futures. However, it is essential for investors to read the contract details carefully to avoid having to deliver 100 ounces of gold on the settlement date because some contracts settle in dollars while others settle in gold.

Futures options are also an ideal alternative; since they offer the option holder the right to purchase the futures contract within a specified time frame and at a predetermined price. An option has the dual advantages of leveraging your initial investment while preventing losses from the price paid.

The disadvantage of an option is that the investor must pay a premium over the underlying value of the gold to own the option, unlike a futures investment, which is based on the current price of gold.

Guidelines For Picking The Best Broker For Gold Trading

Selecting the best gold broker is just as crucial to gold trading as establishing your trading strategies. The reason for this is that the broker needs to be able to give you the resources and assistance you’ll need to conduct your online trading operations.

The following are the main factors you should consider when selecting the best gold trading broker:

Regulation

Regulation is the most crucial factor that you should consider to ensure that you only deal with a licensed broker. This guarantees the security of your hard-earned money because regulators require that both client and company funds be kept in separate accounts.

Trading Platforms

No matter what level of experience you have, the best gold trading broker will always provide you with a variety of trading platforms. Numerous platforms provide a great deal of flexibility, allowing you to select the one that best suits your requirements and level of risk tolerance.

Services Provided

The services the gold broker provides are another crucial factor you should consider. Various kinds of brokers, including discount and full-service online forex brokers, provide international trading and the highest standard of customer support.

In this regard, it’s crucial to consider factors like the minimum deposit needed to open an account, trade size, margin requirements, leverage, available currencies for operating your account, methods for transferring funds into your trading account, and the simplicity of money withdrawal from your account when selecting the best gold trading broker.

Investment Opportunities

An ideal gold broker should offer a wide variety of investment options in the precious metal trade. You should be able to purchase gold directly or invest cash into mutual funds, ETFs, or gold futures and options. An extensive investment option enables you to diversify your portfolio and increase your investment earnings, so understanding this is crucial.

5 Of The Best Gold Stocks To Consider

The process of selecting the best gold mining stock can be complex; hence, the reason why you should evaluate these three factors things when choosing the best gold stocks to buy:

- The management of the company

- The financial statements of the business (income statement, balance sheet, cash flows, and dividend yield)

- The company’s fundamental principles (earnings per share, revenue, etc.)

1. Barrick Gold (ABX)

Barrick Gold has some of the most valuable gold stocks. This Canadian-based company pays a high dividend yield since it has mining operations in 13 nations, including Tanzania, the United States, Saudi Arabia, Argentina, and Australia. It is traded on the Toronto Stock Exchange and the New York Stock Exchange.

2. Newmont Corporation (NEM)

This company is the world’s leading producer and supplier of gold. Newmont Corporation has mining operations on five continents. Look up Newmont Corporation on the New York Stock Exchange if you want to invest in the best gold stocks.

3. Kinross Gold (K)

Kinross Gold is a gold mining company based in Toronto. It operates in several nations, including Mauritania, Brazil, Ecuador, Canada, and the United States. Although Kinross is not as well-known as Newmont Corporation and Barrick Gold, experts predict it will significantly increase its production in the coming months. The New York Stock Exchange is where you can find this company listed.

4. Newcrest Mining (NCM)

This Australian-based company has the largest gold ore reserves in the world. With operations in Australia, Canada, Papua New Guinea, and Indonesia, Newcrest Mining is ranked fifth in the world for gold production. The Australian Securities Exchange allows you to trade these stocks and learn more about Newcrest Mining gold shares.

5. Eldorado Gold (ELD)

Eldorado Gold is a company that operates in North America, South America, Europe, and the Middle East in the gold mining, exploration, and development sectors. You can find their gold stocks by checking out the Toronto and New York Stock Exchanges.

Final Remarks

Gold may provide an investment haven if you’re apprehensive about inflation and other disasters. However, it is essential to note that it can be just as volatile in the short term as stocks, but it has a solid long-term value retention.

Depending on your preferences and risk tolerance, you can invest in gold stocks, physical gold, gold ETFs, mutual funds, or speculative futures and options contracts. Fortunately, this article has provided you with essential information to help you navigate the gold market and make an informed decision.