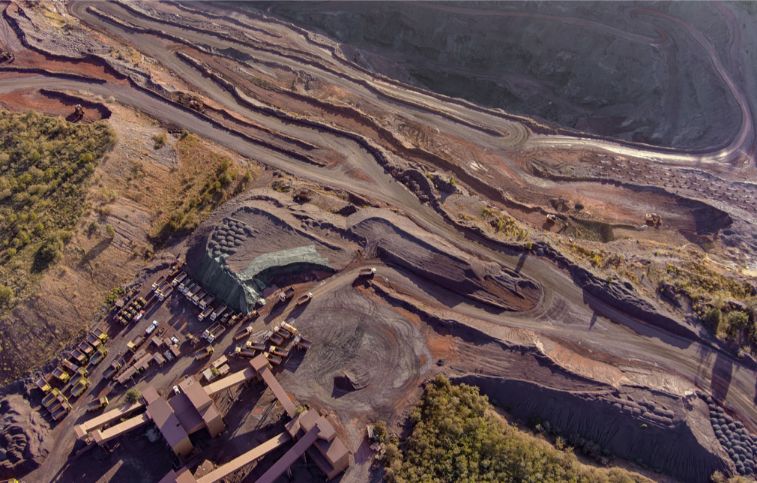

Globex Mining Enterprises Inc. (TSX: GMX) recently reported that Emperor Metals Inc. successfully closed the first tranche of their flow-through financing, worth $2,335,817. This money will be allocated towards exploring Globex’s 50% owned Duquesne West-Ottoman property in Duparquet, Quebec. This site is situated along the gold-rich Porcupine-Destor Break. The property has been identified as a potential location for gold mineralization through a NI 43-101 report compiled by David Power-Fardy and Kurt Breede of Watts Griffis and McOuat in October 2011.

The report stated that the property contains an Inferred Gold Resource of 4.17 Mt, grading 5.42 g/t Au cut (6.36 uncut), resulting in 727,000 oz. Au cut and 853,000 oz. Au uncut. Emperor Metals has acquired full ownership of the land from Globex and Géoconseils Jack Stoch Ltée for a total of $10 million in cash, 15 million shares with a minimum value of $0.20 each, $12 million worth of work over five years, as well as a 3% Gross Metal Royalty, of which 1% may be bought for $1 million. Géoconseils’s interest in the property pre-dates Mr. Stoch’s association with Globex.

Sayona Mining Ltd. recently secured the final authorization from the Quebec Government to relaunch their advanced North American Lithium operation in Barraute, Quebec, in the initial quarter of 2023, which is good news for Globex since they possess a 0.5% Gross Metal Royalty at the center of the proposed Authier Lithium Mine open-pit. Electric Royalties, a major shareholder of Globex, similarly holds a 0.5% Gross Metal Royalty at the same center.

Cartier Resources Inc. reported intersecting 3.3 g/t Au over 4.6 meters, including 9.56 g/t Au over 1 meter at a vertical depth of 800 meters in the downdip and plunge of the West Nordeau Deposit. Globex holds a 3 % Gross Metal Royalty on the West Nordeau Deposit Sector of Cartier’s Chimo Mine Project. The Cartier longitudinal section proposed several extra drill holes to expand the 311,000 oz Au Indicated and Inferred Resource.

Finally, Globex observes the ongoing enhancement in Yamana Gold Inc.’s value to $7.48 per share. Globex currently owns 706,714 shares of Yamana, valued at $5,286,220.